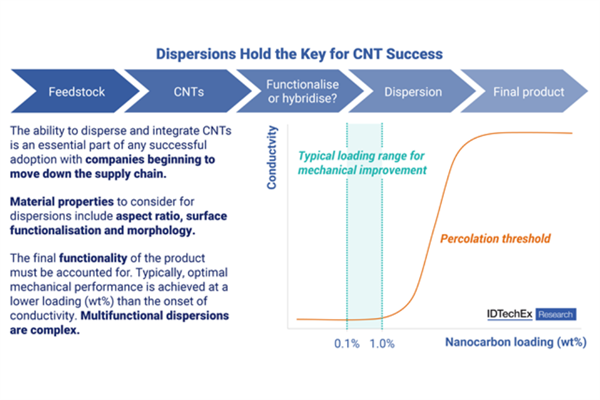

As outlined in a recent IDTechEx report, uniform dispersion is critical to leveraging CNTs’ full spectrum of mechanical, electrical, and thermal benefits—particularly in applications such as paints, coatings, and energy storage.

The commercial viability of carbon nanotubes (CNTs) continues to depend heavily on one decisive factor: effective dispersion. CNTs naturally agglomerate due to their high aspect ratio and strong van der Waals forces, leading to uneven distribution and compromised performance. A stable, homogeneous dispersion is essential for reducing CNT loading levels, improving formulation processing, and enhancing end-use performance across a range of sectors.

In paints and coatings, CNTs offer unique value propositions—particularly where multifunctionality is required. At low loadings, CNTs can introduce conductivity, enabling anti-static coatings, EMI shielding, and lightning strike protection. These features are increasingly sought after in aerospace, automotive, and electronics sectors.

Beyond conductivity, CNT-reinforced coatings exhibit enhanced durability, abrasion resistance, and impact strength. These improvements are driven by mechanisms such as crack bridging, energy dissipation, and improved stress transfer from the matrix to the nanomaterials. For structural and protective coatings, CNTs can also improve UV resistance and corrosion protection, offering extended lifecycle performance.

However, the journey from lab-scale CNT promise to commercial-scale coating performance is far from straightforward. Dispersion directly impacts rheology, pot life, and curing kinetics of coatings—making it a central challenge in formulation development.

Many coating systems—particularly water-based or solvent-based formulations—require precise compatibility between CNTs and dispersants, binders, and other additives. Inconsistent dispersion can result in defects such as microvoids, agglomerates, or inconsistent conductivity paths, significantly undermining product performance.

To tackle these issues, manufacturers are developing pre-dispersed CNT concentrates and hybrid materials. For instance, Nanocyl, now part of Birla Carbon, has launched hybrid CNT–carbon black masterbatches tailored for conductive coatings. These hybrids aim to balance the dispersion profiles of both materials—CNTs dispersing under high shear, and carbon black under low shear—resulting in more process-friendly options. These are now available in systems such as polypropylene (PP), polycarbonate (PC), and high-impact polystyrene (HIPS), with up to 30 wt% nanocarbon content.

One of the most persistent myths in nanocarbon applications is that a single CNT grade or formulation will deliver optimal performance in any matrix. In reality, paints and coatings—especially those engineered for niche functions like radar absorption, de-icing, or thermal dissipation—require careful optimisation of CNT type, concentration, and dispersion method.

Typically, 0.1–1 wt% CNT loading suffices for mechanical enhancements, while conductivity requires higher thresholds. Achieving both simultaneously—mechanical and functional benefits—is possible but requires tight control over formulation and process parameters.

As demand for high-performance coatings grows, especially in energy, aerospace, and defence, the importance of reliable CNT dispersion is no longer just a technical issue—it’s a commercial differentiator. While some formulators maintain in-house dispersion capability, many are turning to specialist partners. Firms such as Toyocolor and NanoRial are carving out niches as high-end dispersion providers, the latter already working with major energy storage companies like CATL and NEO Battery Materials.

At the same time, large CNT producers are moving downstream. Companies like LG Chem and Cnano are building vertically integrated supply chains and offering pre-dispersed CNT pastes and slurries, including those suitable for coatings and printing applications. According to IDTechEx, CNT pastes now account for over 95% of revenue for some suppliers—highlighting the market's clear pivot toward dispersion-ready formats.