Coatings are a vital tool across numerous industries worldwide. Thomas Bithell, a technology analyst at market intelligence firm IDTechEx, has shared a new release offering insights into the potential applications of advanced coatings technologies.

The demand for advanced coatings is accelerating across expanding sectors such as electric vehicle (EV) batteries, aerospace, wind energy, oil and gas, data centres, and construction. As products are pushed to perform in harsher environments while meeting stricter efficiency and sustainability requirements, coatings are emerging as a critical enabler of reliability and performance.

Advanced coatings can improve manufacturability, extend lifetimes, reduce maintenance requirements, and facilitate higher performance. With industrialisation continuing in emerging economies and electrification reshaping mature markets, the advanced coatings sector is positioned for significant long-term growth.

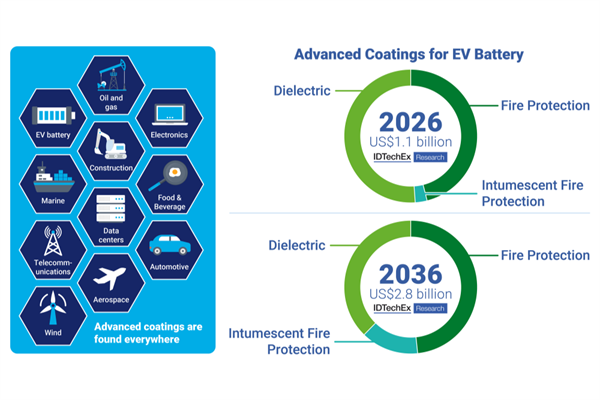

The new report from IDTechEx, ‘Advanced Coatings 2026–2036: Market, Technologies, Players’, provides an independent assessment of technological and commercial developments in advanced coatings. Coverage spans fire protection, EMI shielding, anti-corrosion, dielectric, thermally conductive, PFAS-free, self-healing, and IR-reflective coatings. IDTechEx evaluates technology options, identifies growth opportunities and potential barriers, and provides a market outlook for advanced coatings over the next decade.

A coating is a material applied to the surface of an object, typically to enhance appearance, improve performance, or provide protection. IDTechEx defines advanced coatings as either emerging coating materials/technologies or emerging applications of existing technologies. Their functionalities include fire protection, EMI shielding, corrosion protection, dielectric insulation, and thermal conductivity, among others. Many advanced coatings are multifunctional, offering combinations such as dielectric insulation with protection from corrosion, moisture, and chemicals.

Several converging trends underpin demand. Growth in industries like EVs, aerospace, offshore wind, and electronics is creating demand alongside high-performance requirements. Aerospace coatings, for example, must remain lightweight while resisting UV, abrasion, and extreme temperatures, whereas offshore wind installations demand durable anti-corrosion protection in highly corrosive environments.

Energy efficiency is another critical driver. IR-reflective coatings can reduce cooling costs in construction and transport, while thermally conductive coatings improve thermal management in EVs and data centres.

Product lifecycle considerations are reshaping expectations. OEMs and regulators increasingly prioritise durability and reduced maintenance cycles, a demand that coatings are well-placed to meet. Meanwhile, technological advances are enabling new applications, such as temperature-dependent reflectivity coatings for polytunnels.

Infrastructure expansion in emerging economies adds further growth momentum, while sustainability pressures—such as replacing PFAS, reducing VOC content, and removing other harmful substances—present challenges for manufacturers, driving the development of safer products.

Applications span a wide range of industries. In EV batteries, advanced coatings can protect cells and packs through dielectric insulation, thermal management, fire protection, and corrosion protection. Wind turbines represent another growing market, with anti-corrosion coatings projected to grow at a 6.8% CAGR between 2026 and 2036, reflecting the push towards larger turbines and more wind projects.

The oil and gas industry continues to rely on protective systems that extend infrastructure lifetimes under harsh conditions. In 2025, Sherwin Williams and Hempel were among many leading players launching advanced coatings solutions for corrosion under insulation. In construction, IR-reflective coatings are gaining traction.

In ‘Advanced Coatings 2026–2036: Market, Technologies, Players’, IDTechEx assesses both the latest and established technologies through benchmarking and analysis, highlighting commercial activity from leading players to startups. From AkzoNobel’s new Resicoat product line to AssetCool’s innovative powerline coatings and robotics, the report details current market activity.

Each coating technology is accompanied by a market outlook, including detailed 10-year forecasts for anti-corrosion and EV battery coatings. The report also provides a SWOT analysis of PFAS alternative coatings ahead of an impending ban, and examines non-specialist and specialist application technologies, alongside alternative materials such as films, inorganic shielding, and fibres.

Advanced coatings are increasingly a fundamental requirement across industries, enabling safety, durability, efficiency, and sustainability. From thermal management in EV batteries to anti-corrosion protection in offshore wind and fire protection in data centres, these coatings meet urgent performance needs while opening pathways for innovation.

‘Advanced Coatings 2026–2036: Market, Technologies, Players’ offers an independent, definitive assessment of this market. With extensive experience in advanced materials, IDTechEx provides unbiased outlooks, technology comparisons, and analysis of key players in the coatings sector.